In 2026, gift card trading will become a mainstream digital activity in Nigeria. What used to be a small underground exchange has now evolved into a structured market where people convert gift cards like Steam, iTunes, Amazon, and eBay into cash, crypto, or USDT within minutes. With this growth comes an important question that every trader must ask: where is it actually safer to trade? Today, traders are faced with two main options: mobile trading apps vs websites. Both promise speed, convenience, and good rates, but safety remains the deciding factor. One wrong move can lead to stolen codes, delayed payments, or total loss.

This takes a deep look at gift card trading apps versus websites in 2026, breaking down how they work, where risks exist, and why platforms like Regiftme are setting the standard for secure trading.

Gift Card Trading in Today’s Digital Economy

Gift card trading is the process of exchanging unused gift cards for money or digital assets. In Nigeria, this usually means converting cards into naira, USDT, or cryptocurrency. Cards like Steam, iTunes, Amazon, Google Play, and eBay dominate the market due to their global acceptance.

As more Nigerians earn online and receive digital rewards, gift cards have become an alternative store of value. This has pushed trading platforms to innovate, offering faster payouts and multiple payment options.

However, innovation also attracts scammers, making safety the most important factor when choosing where to trade.

The Rise of Mobile Trading Apps in Nigeria

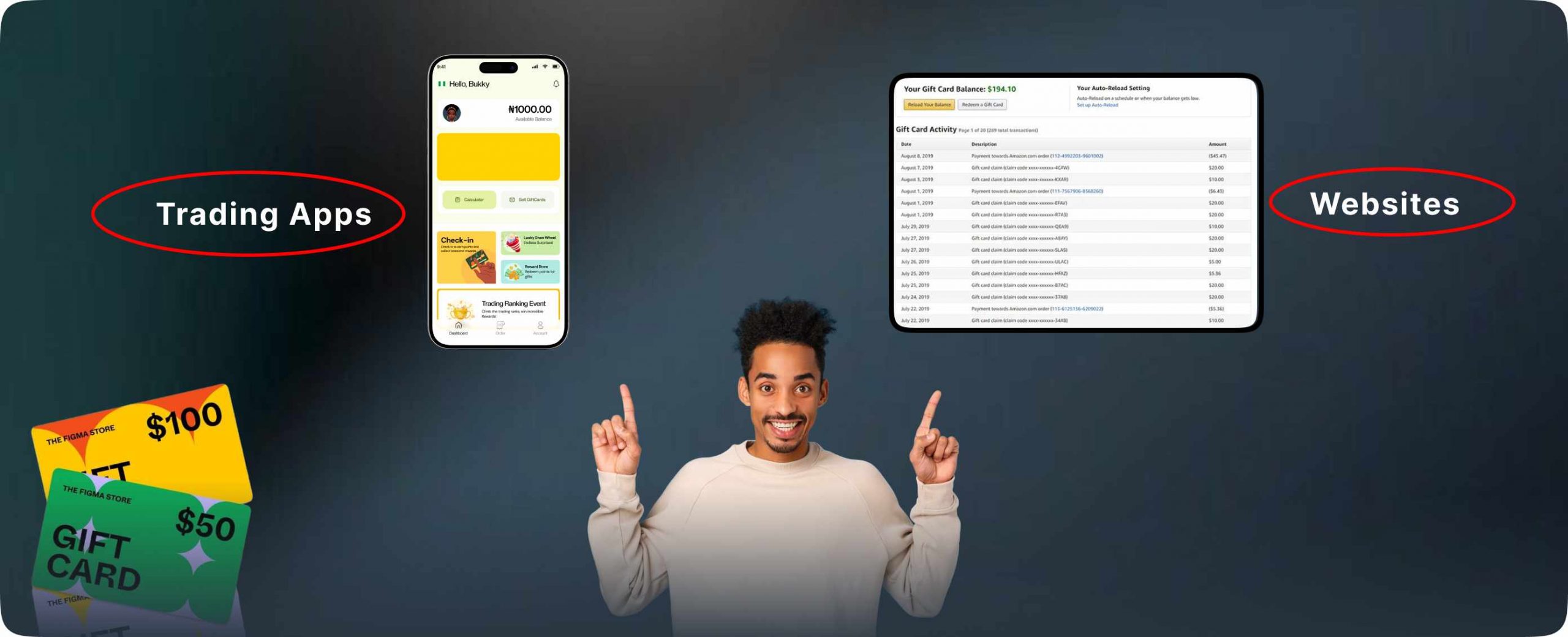

Mobile trading apps have grown rapidly in popularity. They offer convenience, allowing users to trade gift cards directly from their phones without opening a browser. Notifications, saved profiles, and quick uploads make the experience feel seamless.

For frequent traders, apps can feel faster and more personal. Many apps also integrate wallets, making it easy to receive funds immediately after verification.

Despite these advantages, not all apps are built with strong security frameworks, which raises concerns for users who value safety over speed.

Why Trading Websites Still Dominate the Market

Web-based trading platforms have been around longer than most mobile apps. They are often seen as more stable because they operate on structured systems with layered security.

Websites allow users to see detailed transaction histories, rate tables, and verification steps clearly. This transparency builds trust, especially for first-time traders.

Platforms like Regiftme use secure web systems combined with real-time support to ensure users are protected throughout the trading process.

Trading Apps vs Websites in Terms of Security

When it comes to Trading Apps vs Websites, security is the biggest comparison point. Apps rely heavily on device security, meaning a compromised phone can expose sensitive data.

Websites, on the other hand, often use advanced encryption, secure servers, and multi-step verification processes. This reduces the risk of unauthorized access.

In 2026, safer platforms combine both approaches: strong backend systems with user-friendly interfaces without sacrificing protection.

Trading Apps vs Websites and User Verification

Another major difference in Trading Apps vs Websites is how user verification is handled. Some apps rush verification to speed up onboarding, which can open doors for fraud.

Websites usually implement stricter verification processes, including email confirmation, identity checks, and transaction reviews. While this may take a little longer, it significantly improves safety.

Regiftme balances this perfectly by offering fast verification without compromising on security standards.

Trading Apps vs Websites for Payment Reliability

Payment reliability is where Trading Apps vs Websites becomes very clear. Some apps struggle with delayed payouts due to wallet glitches or server issues.

Well-structured websites usually connect directly to payment systems, ensuring smoother and more reliable payouts. This is especially important for large-value cards like Amazon or Steam gift cards.

Regiftme supports payments in naira, crypto, and USDT, giving users flexibility without delays. For urgent assistance, users can also reach support via +8619198157161.

The Role of Crypto and USDT in Secure Trading

In 2026, crypto will become a major part of gift card trading. Many users prefer receiving USDT because of its stability and ease of transfer.

However, crypto transactions require strong security systems. Platforms must protect wallets from breaches and ensure accurate transfers.

Regiftme integrates crypto payouts safely, allowing users to trade gift cards like iTunes, Steam, and Amazon while receiving value in USDT or other supported assets.

Risks Traders Face on Apps and Websites

One common risk is phishing. Fake apps and cloned websites often trick users into submitting gift card codes. Another issue is dealing with unverified agents who promise higher rates.

Apps downloaded outside official stores and websites without secure connections are especially dangerous. These risks are not always obvious to new traders.

Using a trusted platform like Regiftme drastically reduces exposure to these threats. Users can also confirm transactions or rates via +8619198157161 before proceeding.

How Regiftme Bridges Safety and Convenience

Regiftme stands out by combining the strengths of both apps and websites. Its system is built on secure web infrastructure while maintaining a smooth, app-like user experience.

Every transaction goes through proper verification, and users can trade multiple gift cards including Steam, iTunes, Amazon, and eBay with confidence. Payment options include naira and crypto, making it suitable for modern traders.

With responsive support and transparent processes, Regiftme continues to raise the safety standard in Nigeria’s gift card trading space.

The Future of Trading Apps vs Websites in 2026 and Beyond

As technology advances, the gap between apps and websites will continue to close. The safest platforms will be those that focus on backend security rather than surface-level convenience.

Regulations, better encryption, and improved verification systems will shape the future of gift card trading. Users will become more informed, demanding transparency and reliability.

In the end, safety will always outweigh speed, especially when real money and digital assets are involved.

Gift card trading in 2026 is no longer just about convenience, it’s about trust, security, and smart choices. Whether you’re trading Steam, iTunes, Amazon, or converting cards to USDT, the platform you choose matters more than ever.